Investing is all about knowledge — any investment advisor worth their salt will tell you that. Growing a portfolio takes dedication to understanding as well as smart decision-making. The truth is, the longer your investment timeline the more risk tolerance your money can handle, and the less you should worry about down periods in the market. One point of knowledge in your tool belt should be Wealth Rocket, an exhaustively collected body of knowledge dedicated to helping you make smart financial decisions in every aspect of your monetary life.

All this being said, the stock market shouldn’t be your only point of call when considering new investment vehicles to continue growing your wealth of assets. There are many alternatives to the traditional stock market that can and should be used to bolster your overall portfolio and introduce new streams of income into its moneymaking ability. For more on the mechanics of alternative investing look into Yieldstreet review pages. To get you started, here are some alternative investment ideas to diversify your portfolio.

Try precious metals for a tangible asset with lasting growth potential.

Adding gold, silver, or platinum assets to your portfolio is a great way to lock in value that you can leverage for additional buying power. These metals also grow fairly steadily, increasing exponentially in value over the course of the years within your possession. Gold bullion is a “gold” standard in seeking vehicles for long term growth that are not reliant on stock market pricing. Gold increases based on a supply curve that is not tethered to business value and can give you increased hedging power when the market sees a temporary downturn.

Precious metals also work as collateral while securing loans for other purchases, like real estate properties. Utilizing your portfolio to continue growing it is something once reserved only for high net worth individuals. However, with the increasing access to alternatives in the stock market, anyone can build up a reservoir of capital that can be leveraged for greater gains.

Consider real estate for an added income stream.

Real estate holdings have produced some of the richest investors in the world. With the help of a sizeable collection of physical assets, you can leverage a mortgage with a minimal down payment and incredibly favorable repayment terms. Real estate falls within two primary categories. You can choose to flip homes or rent them.

Flipping houses requires a fast turnaround, so mortgage repayment terms are far less important. You want to buy homes for bargain prices, conduct some lightning-fast renovations, and then sell the property for a profit. You will repay the loan in a lump sum and pocket the difference.

Alternatively, you can use rental properties to create a monthly income that supplements your regular salary payments. With these types of property investments, it’s best to secure low-interest rates because you will want to pay the loan off over a longer time frame, utilizing the collected rent to cover the bulk or sum of the monthly mortgage payments.

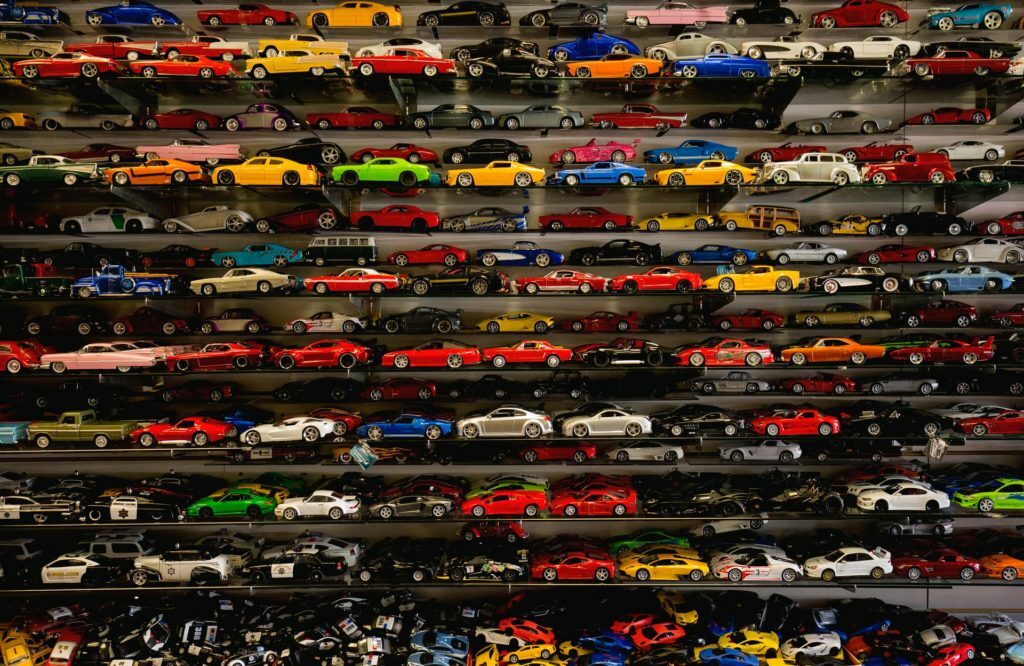

Try collectible memorabilia for a niche approach.

Finally, working with collectibles may be the perfect way to diversify your portfolio. Rare baseball cards, signed football jerseys, or signed first editions of high-value literature can all form a highly profitable arm of your total investment portfolio.

These items increase in value over time as with any other vehicle. However, in niche spaces, the right buyer may be willing to pay a premium today, giving you access to inflated pricing today instead of after years of holding the article. With niche items, finding the right marketplace and buyer is the name of the game, but it can be extremely profitable.

Finding alternative investments is all about locating your strategy. Honing in on the things you know the most about and can bargain for is the surest way to turn a profit and increase your portfolio value.